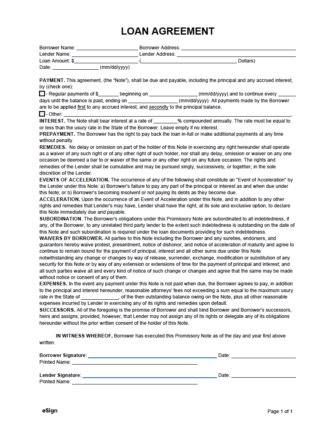

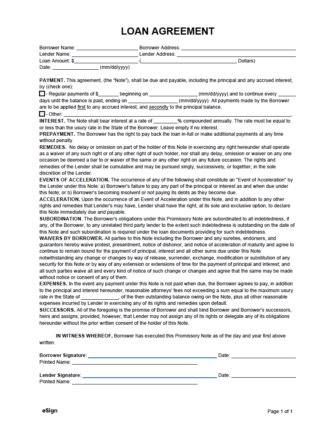

A simple (1-page) loan agreement is a written contract formed between a party that lends money to a receiving party. The purpose of the document is to set the legally binding terms that will remain in place until the loan is paid off, such as the payment schedule the borrower will be required to follow. All of the document’s contents fit on a single page, reducing its complexity while still maintaining the necessary terms and conditions to effectively bind the parties.

Borrower Name: [BORROWER NAME] Borrower Address: [BORROWER ADDRESS]

Lender Name: [LENDER NAME] Lender Address: [LENDER ADDRESS]

Loan Amount: $ [AMOUNT]

Date: [MM/DD/YYYY]

PAYMENT. This agreement (the “Note”) shall be due and payable, including the principal and any accrued interest, by (check one):

☐ – Regular payments of $ [PAYMENT] beginning on [MM/DD/YYYY] and to continue every [#] day of the month until the balance is paid, ending on [MM/DD/YYYY] . All payments made by the Borrower are to be applied first to any accrued interest and secondly to the principal balance.

☐ – Other: [OTHER PAYMENT SCHEDULE] .

INTEREST. The Note shall bear interest at a rate of [INTEREST RATE] % compounded annually. The rate must be equal to or less than the usury rate in the State of the Borrower. Leave empty if there is no interest.

PREPAYMENT. The Borrower has the right to pay back the loan in full or make additional payments at any time without penalty.

REMEDIES. No delay or omission on part of the holder of this Note in exercising any right hereunder shall operate as a waiver of any such right or of any other right of such holder, nor shall any delay, omission, or waiver on any one occasion be deemed a bar to or waiver of the same or any other right on any future occasion. The rights and remedies of the Lender shall be cumulative and may be pursued singly, successively, or together at the sole discretion of the Lender.

EVENTS OF ACCELERATION. The occurrence of any of the following shall constitute an “Event of Acceleration” by the Lender under this Note: a) the Borrower’s failure to pay any part of the principal or interest as and when due under this Note; or b) the Borrower becoming insolvent or not paying its debts as they become due.

ACCELERATION. Upon the occurrence of an Event of Acceleration under this Note, and in addition to any other rights and remedies that the Lender’s may have, the Lender shall have the right, at its sole and exclusive option, to declare this Note immediately due and payable.

SUBORDINATION. The Borrower’s obligations under this Promissory Note are subordinated to all indebtedness, if any, of the Borrower, to any unrelated third party lender to the extent such indebtedness is outstanding on the date of this Note, and such subordination is required under the loan documents providing for such indebtedness.

WAIVERS BY BORROWER. All parties to this Note, including the Borrower and any sureties, endorsers, and guarantors, hereby waive protest, presentment, notice of dishonor, and notice of acceleration of maturity and agree to continue to remain bound for the payment of principal, interest and all other sums due under this Note notwithstanding any change or changes by way of release, surrender, exchange, modification or substitution of any security for this Note or by way of any extension or extensions of time for the payment of principal and interest; and all such parties waive all and every kind of notice of such change or changes and agree that the same may be made without notice or consent of any of them.

EXPENSES. In the event any payment under this Note is not paid when due, the Borrower agrees to pay, in addition to the principal and interest hereunder, reasonable attorneys’ fees not exceeding a sum equal to the maximum usury rate in the State of [STATE NAME] , of the then outstanding balance owing on the Note, plus all other reasonable expenses incurred by the Lender in exercising any of its rights and remedies upon default.

SUCCESSORS. All of the foregoing is the promise of the Borrower and shall bind the Borrower and the Borrower’s successors, heirs, and assigns; provided, however, that the Lender may not assign any of its rights or delegate any of its obligations hereunder without the prior written consent of the holder of this Note.

IN WITNESS WHEREOF, the Borrower has executed this Promissory Note as of the day and year first above written.

Borrower Signature: _________________ Date: [MM/DD/YYYY]

Printed Name: [BORROWER PRINTED NAME]

Lender Signature: _________________ Date: [MM/DD/YYYY]

Printed Name: [LENDER PRINTED NAME]

The top section of the contract establishes the basic information of the loan, including the following details:

This section presents the framework for how the borrower will pay back the loan balance. First, one (1) of the two checkboxes must be selected: if the borrower will be making regular payments to pay off the loan, check the first box; if they will be making different types of payments (such as a single lump-sum payment), check the second box and describe how the borrower will go about making the payment(s).

If the first box was checked, enter the amount ($) of each payment (of principal and interest) that the borrower will make, followed by the date (mm/dd/yyyy) of the first payment, the number (#) of days between payments, and finally the date of the last payment the borrower will make.

If the lender will be charging interest for the loan balance, enter the amount (%) in the field provided. If no interest will be charged, the field can be left blank.

Enter the name of the state in which this loan agreement is being executed. This makes it clear which state laws will govern the loan, including legal fees and maximum usury rates.

To make the loan agreement binding and official, the lender and borrower need to enter their printed names, add their signatures to the form, and enter the date they signed. The signatures can be inscribed by printing the form and signing by hand or by uploading the completed document to eSign and sending the document for signatures.